农业保险(简称“农险”)是专为农业生产者在从事种植业、林业、畜牧业和渔业生产过程中,对遭受自然灾害、意外事故疫病、疾病等保险事故所造成的经济损失提供保障的一种赔偿保险。

Agricultural insurance (abbreviated as "agricultural insurance") is a type of compensation insurance that provides protection for economic losses caused by natural disasters, accidents, diseases, and other insurance accidents for agricultural producers engaged in planting, forestry, animal husbandry, and fishery production processes.

农业保险介绍

农业保险按农业种类不同分为种植业保险、养殖业保险;按危险性质分为自然灾害损失保险、病虫害损失保险、疾病死亡保险、意外事故损失保险;按保险责任范围不同,可分为基本责任险、综合责任险和一切险;按赔付办法可分为种植业损失险和收获险。

Agricultural insurance is divided into planting insurance and livestock insurance according to different types of agriculture; According to the nature of danger, it is divided into natural disaster loss insurance, pest and disease loss insurance, disease death insurance, and accident loss insurance; According to the different scope of insurance liability, it can be divided into basic liability insurance, comprehensive liability insurance, and all risks insurance; According to the compensation method, it can be divided into planting loss insurance and harvest insurance.

保险标的

农作物栽培(农业)、营造森林(林业)、 畜禽饲养(畜牧业)、水产养殖、捕捞(渔业)以农村中附属于农业生产活动的副业。

Crop cultivation (agriculture), afforestation (forestry), animal husbandry (animal husbandry), aquaculture, and fishing (fishing) are sidelines attached to agricultural production activities in rural areas.

主要种类

种植业保险

(1) 农作物保险。

(2)收获期农作物保险。

(3)森林保险。

(4)经济林、园林苗圃保险。

Crop insurance

(1) Crop insurance.

(2) Harvest crop insurance.

(3) Forest insurance.

(4) Economic forest and garden nursery insurance.

养殖业保险

(1)牲畜保险。

(2)家畜保险、家禽保险。

(3)水产养殖保险。

(4)其他养殖保险。

Animal husbandry insurance

(1) Livestock insurance.

(2) Livestock insurance, poultry insurance.

(3) Aquaculture insurance.

(4) Other aquaculture insurance.

主要险种

中国开办的农业保险主要险种有:农产品保险,生猪保险,牲畜保险,奶牛保险,耕牛保险,山羊保险,养鱼保险,养鹿、养鸭、养鸡等保险,对虾、蚌珍珠等保险,家禽综合保险,水稻、油菜、蔬菜保险,稻麦场、森林火灾保险,烤烟种植、西瓜雹灾、香梨收获、小麦冻害、棉花种植、棉田地膜覆盖雹灾等保险,苹果、鸭梨、烤烟保险等等。

The main types of agricultural insurance offered in China include: agricultural product insurance, pig insurance, livestock insurance, cow insurance, plowing cattle insurance, goat insurance, fish insurance, deer, duck, chicken and other insurance, shrimp, clam and pearl insurance, poultry comprehensive insurance, rice, rapeseed, vegetable insurance, rice and wheat field, forest fire insurance, tobacco planting, watermelon hail disaster, pear harvesting, wheat frost damage, cotton planting, etc Cotton fields covered with plastic film for insurance against hail, apples, pears, tobacco, and more.

重要性

一直以来,抗灾救灾、安抚灾民、重建家园的费用主要由国家和地方民政部门负担,也有一少部分来自群众和企业的捐赠。这种模式不仅让国家投出了大量的财力,而且不利于健全的农业风险防范体系的形成。有关专家指出,应尽快建立农业保险机制、成立农业保险公司,更多地用社会的力量来化解农业风险。

Throughout the years, the cost of disaster relief, comforting disaster victims, and rebuilding homes has mainly been borne by the national and local civil affairs departments, with a small portion coming from donations from the public and enterprises. This model not only allows the country to invest a large amount of financial resources, but also hinders the formation of a sound agricultural risk prevention system. Experts point out that agricultural insurance mechanisms and companies should be established as soon as possible, and more social forces should be used to resolve agricultural risks.

据统计,自然灾害每年给中国造成1000亿元以上的经济损失,受害人口2亿多人次,其中农民是最大的受害者,以往救灾主要靠民政救济、中央财政的应急机制和社会捐助,农业保险无疑可使农民得到更多的补偿和保障。

According to statistics, natural disasters cause economic losses of over 100 billion yuan to China every year, with over 200 million people affected. Among them, farmers are the biggest victims. In the past, disaster relief mainly relied on civil affairs relief, emergency mechanisms from central finance, and social donations. Agricultural insurance undoubtedly provides farmers with more compensation and protection.

案例分析

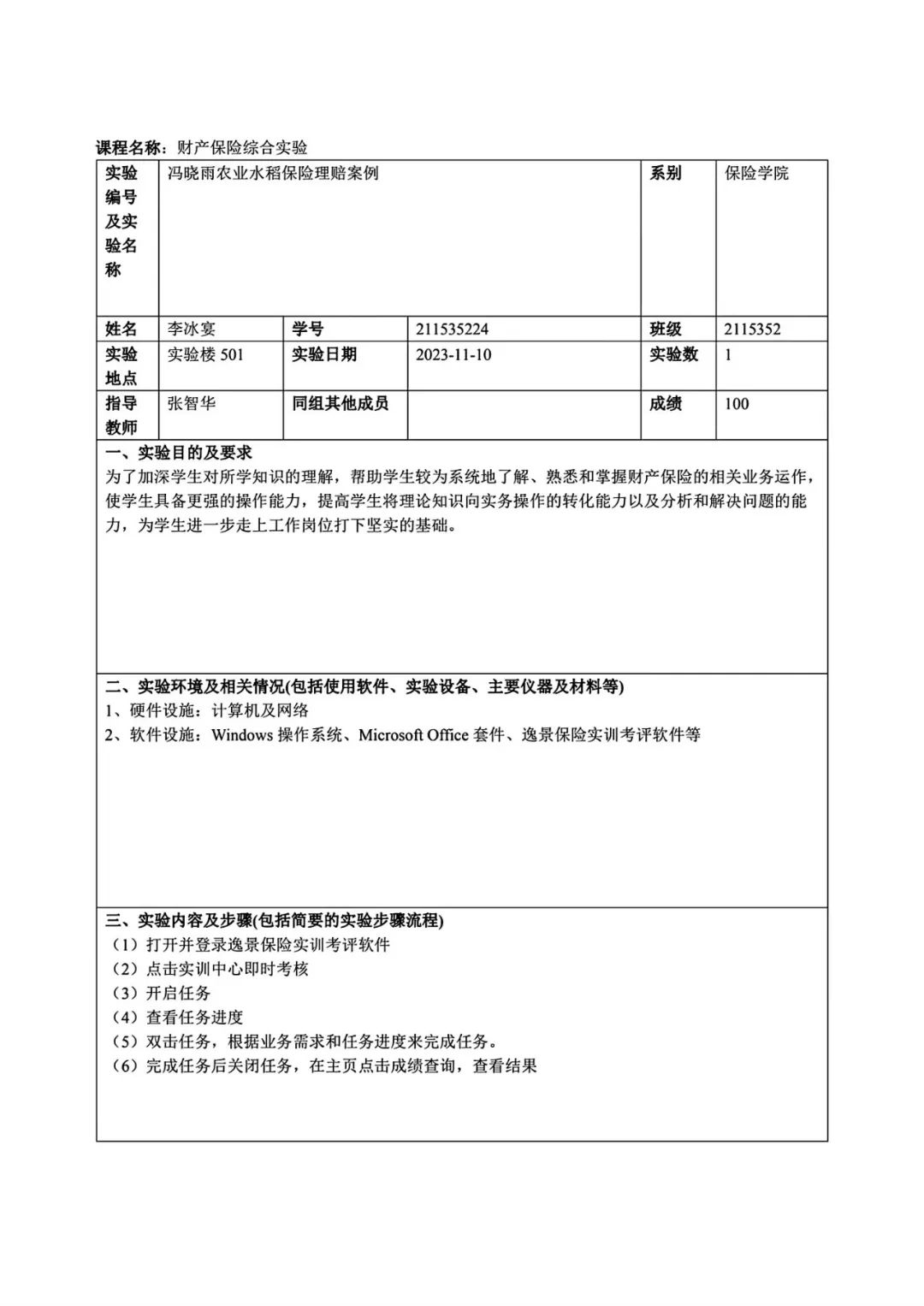

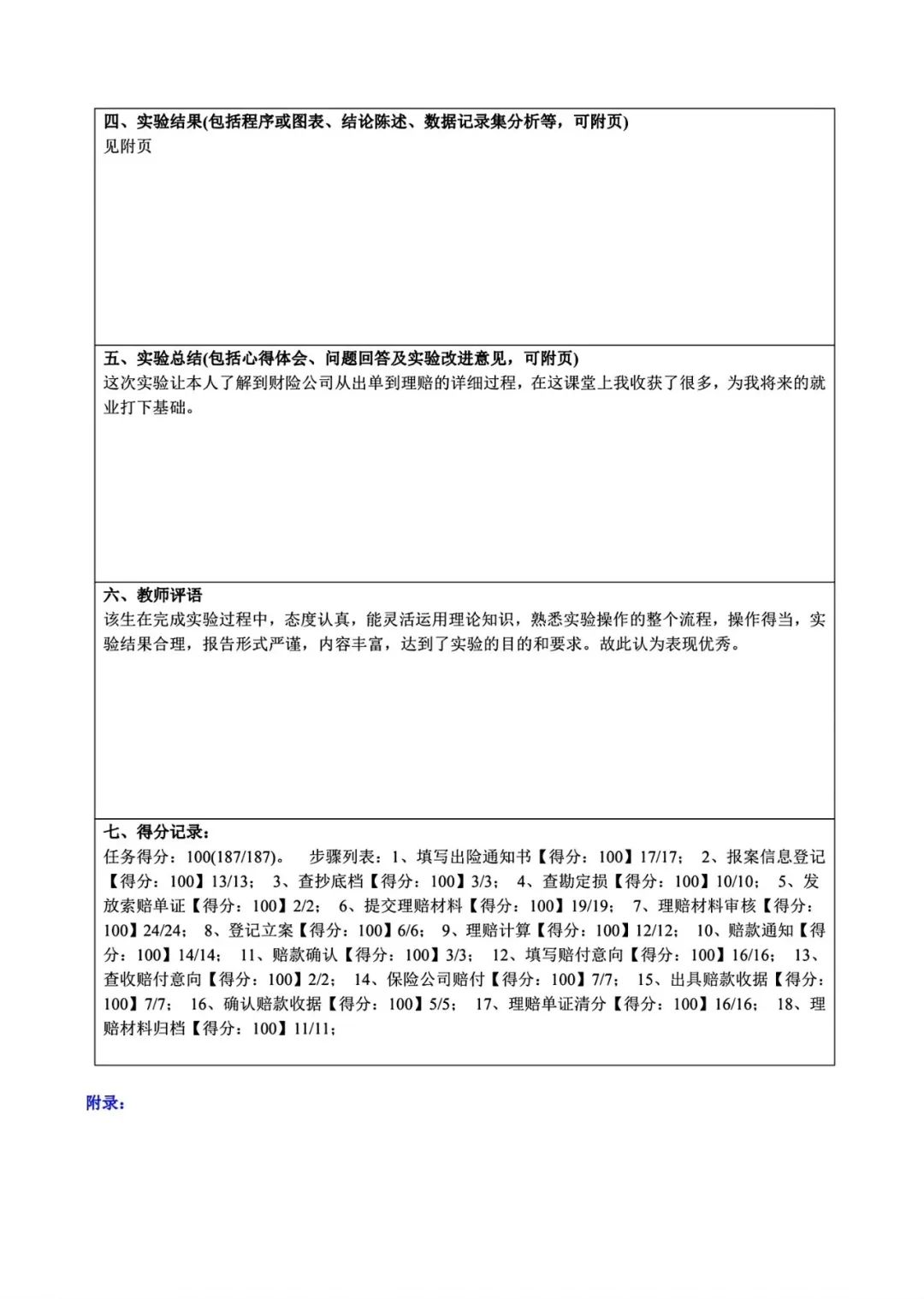

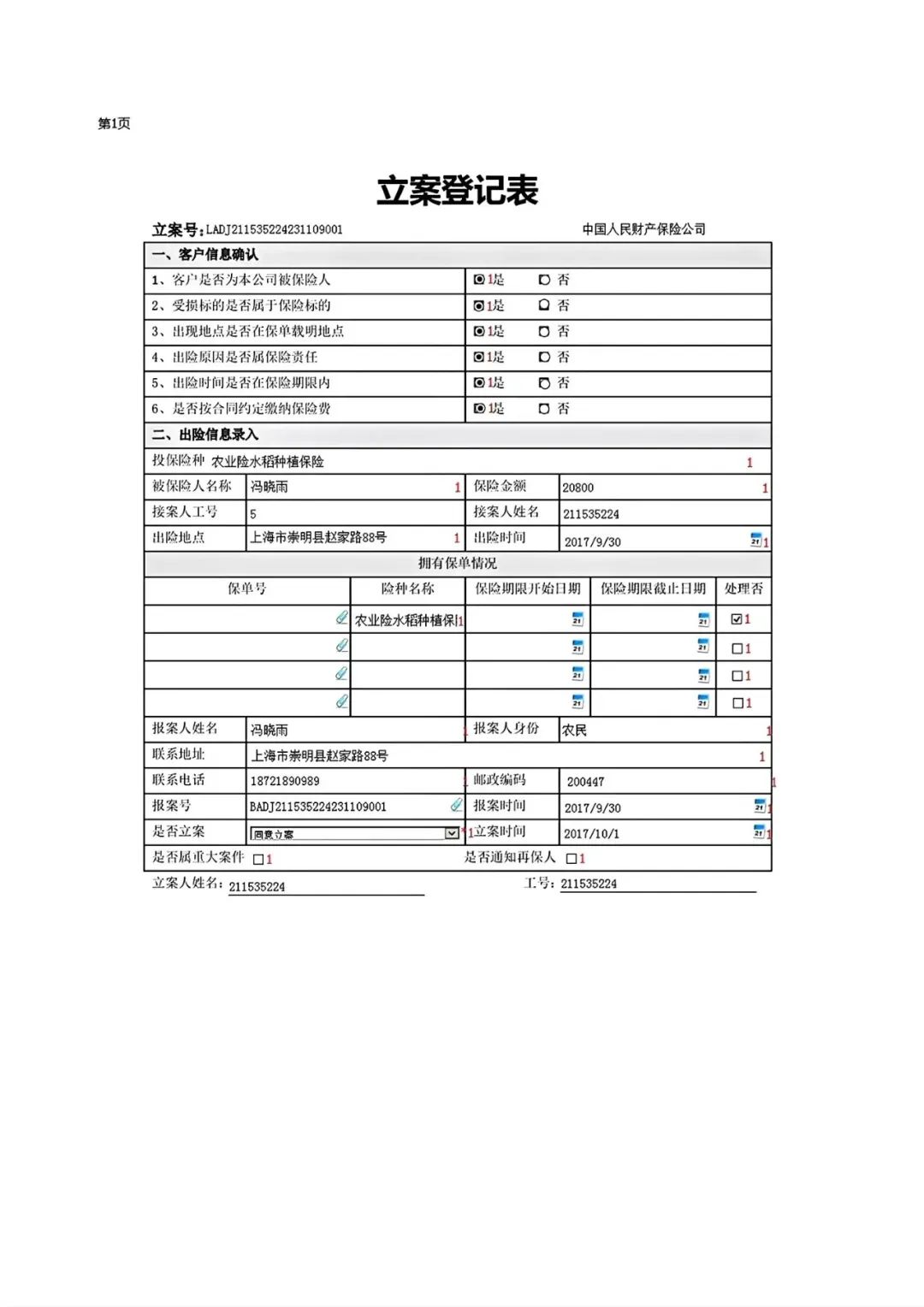

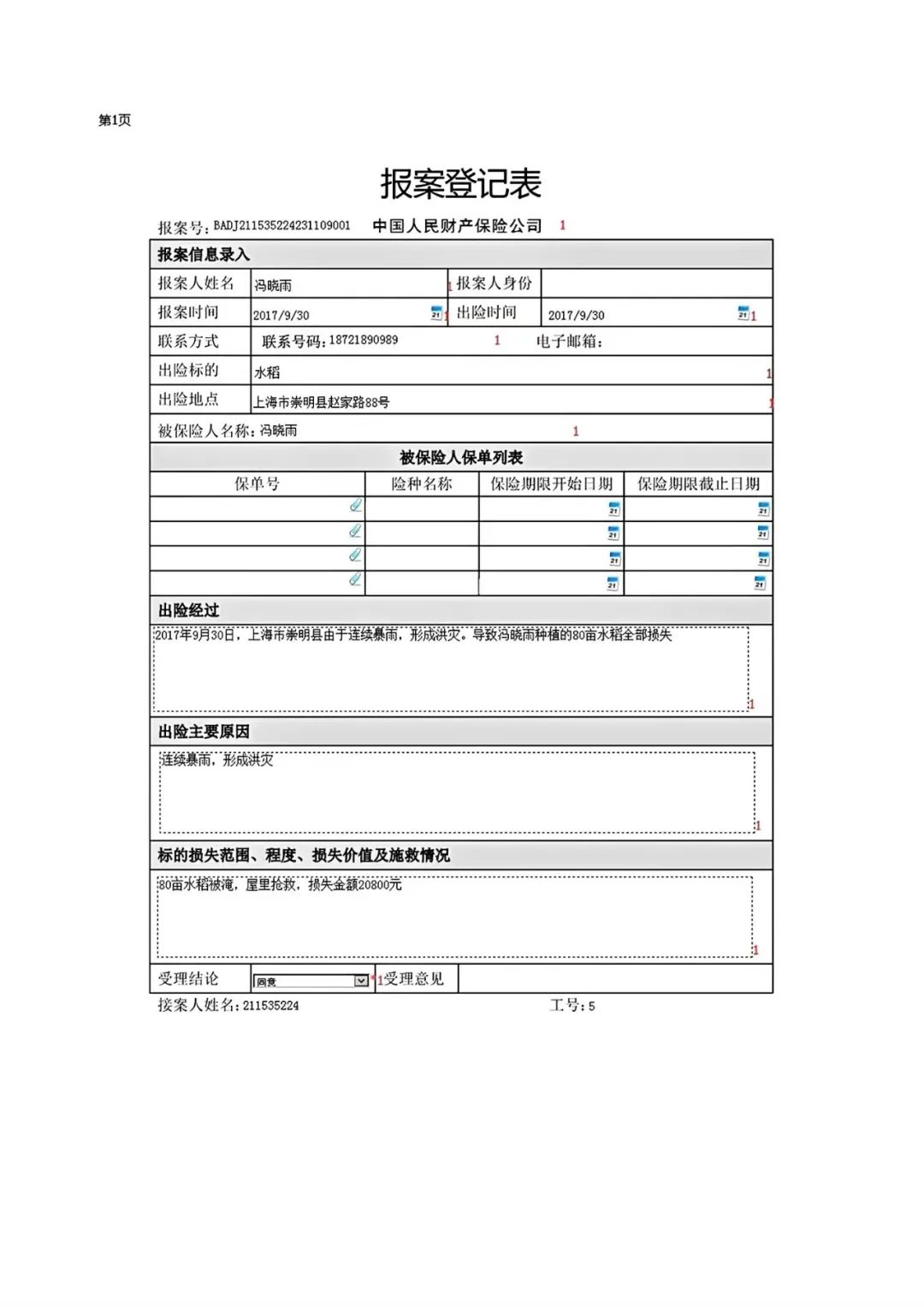

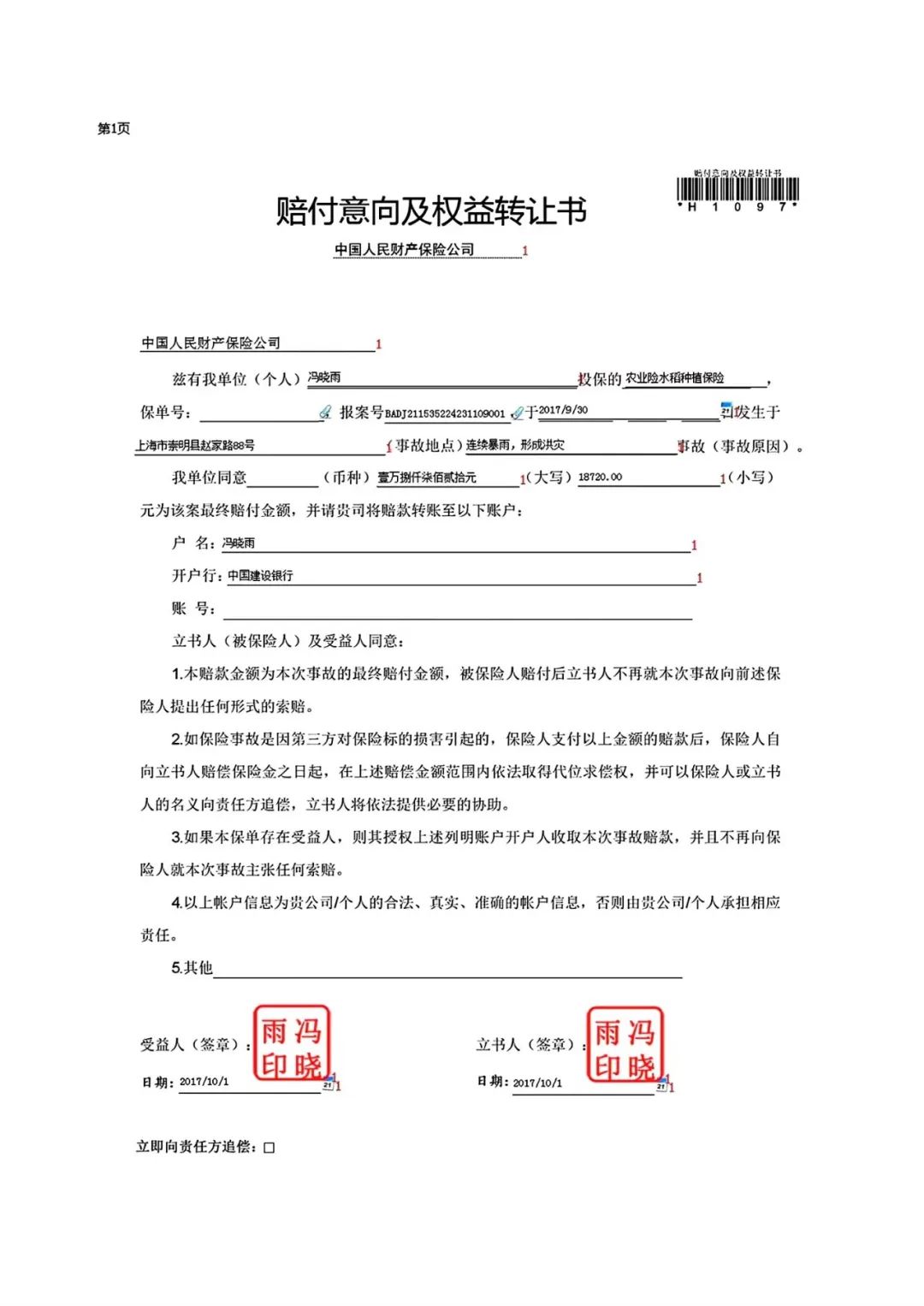

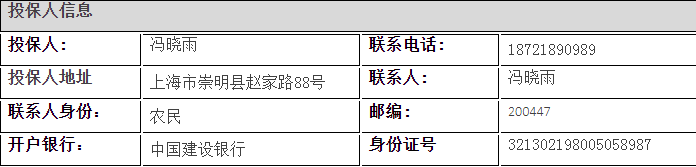

冯晓雨,是一明种粮大户。为了控制水稻生长过程中的风险,于2017年8月1日向中国人民财产保险公司投保了农业险水稻种植保险,保险金额20800元,保险保险期限请看水稻保险条款。

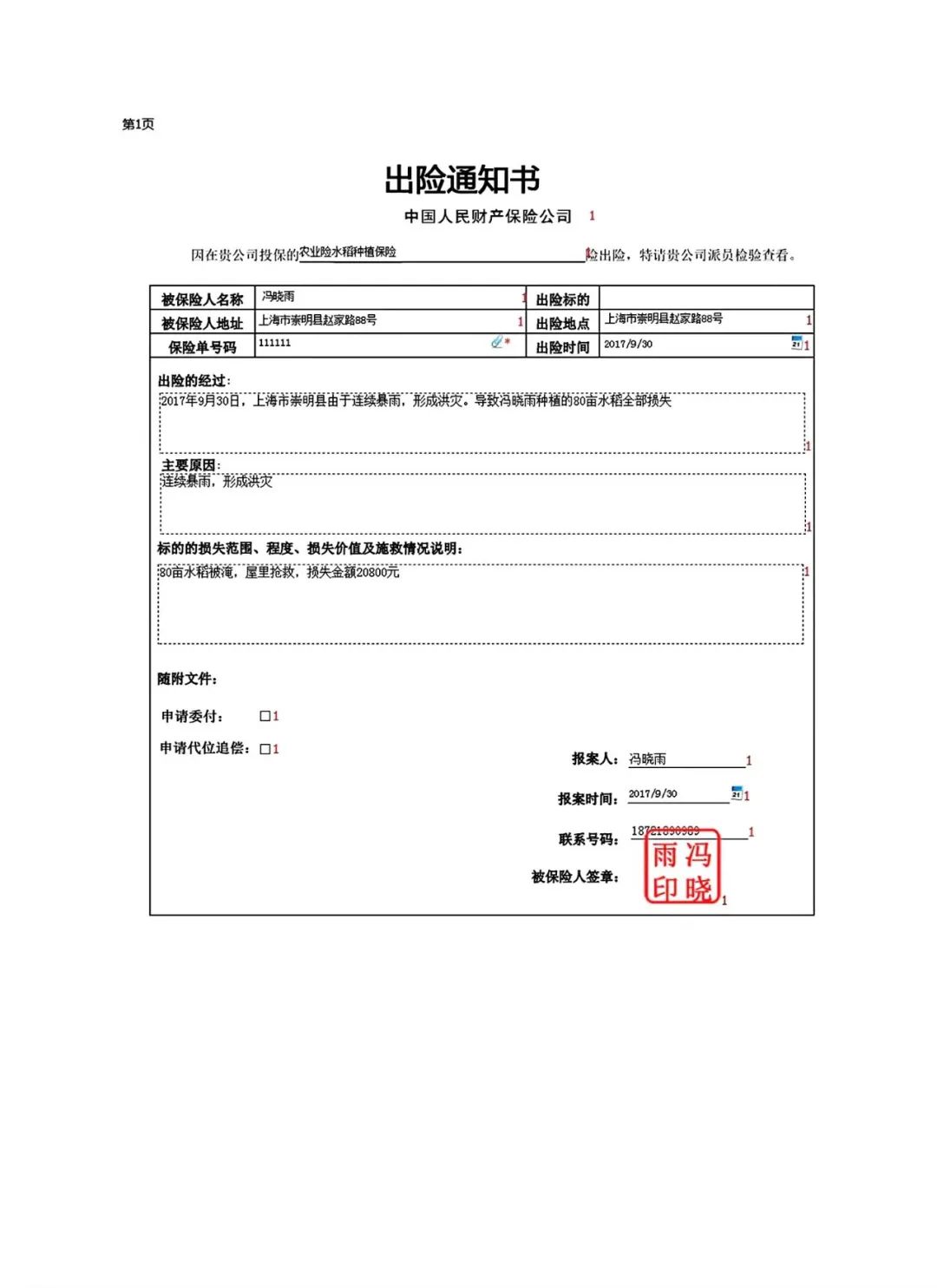

2017年9月30日,上海市崇明县由于连续暴雨,形成洪灾。导致冯晓雨种植的80亩水稻全部损失,事故发生后,冯晓雨向中国人民财产保险公司报案,并如实告知如下事项:

1.出险经过:2017年9月30日,上海市崇明县由于连续暴雨,形成洪灾。导致冯晓雨种植的80亩水稻全部损失;

2.主要原因:连续暴雨,形成洪灾。

3.标的损失范围:80亩水稻被淹,屋里抢救,损失金额20800元。

4.出险地点:上海市崇明县赵家路88号。

5.生长期:扬花灌浆期—成熟期。

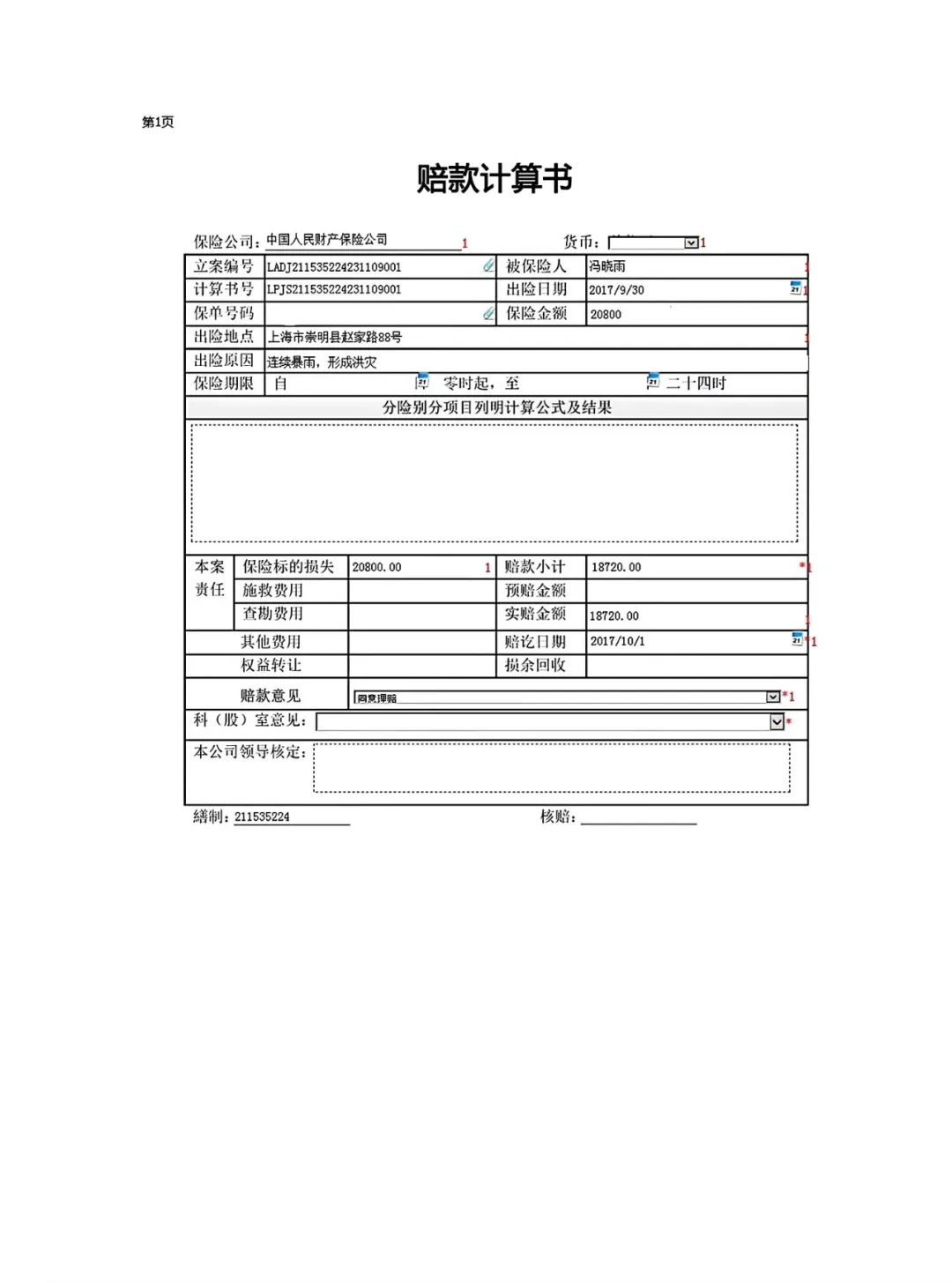

6.免赔额为:10%

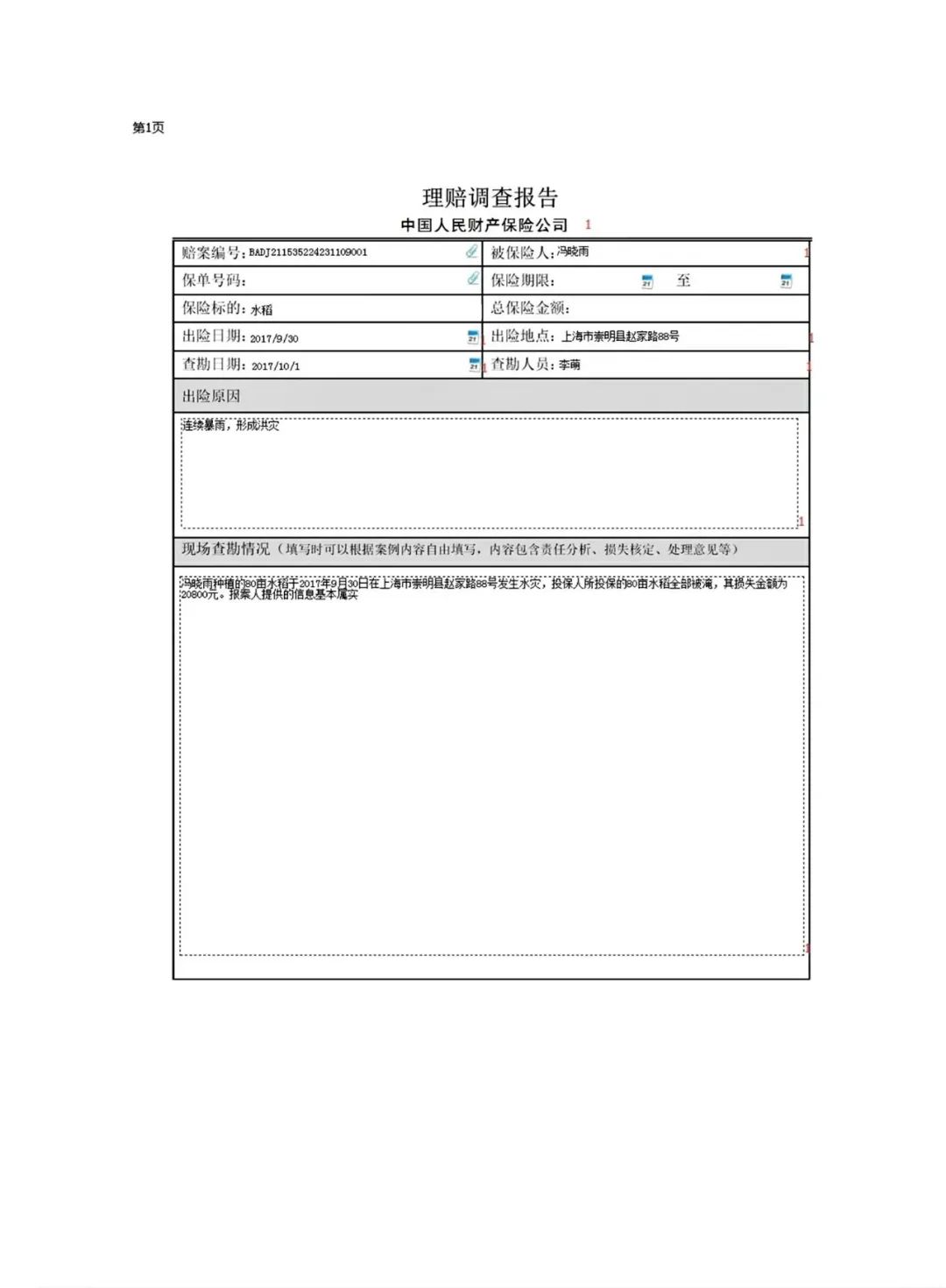

2017年10月1日下午1点,查勘人员李萌及时到出险现场进行了查勘,出具了如下报告:

冯晓雨种植的80亩水稻于2017年9月30日在上海市崇明县赵家路88号发生水灾,投保人所投保的80亩水稻全部被淹,其损失金额为20800元。报案人提供的信息基本属实。

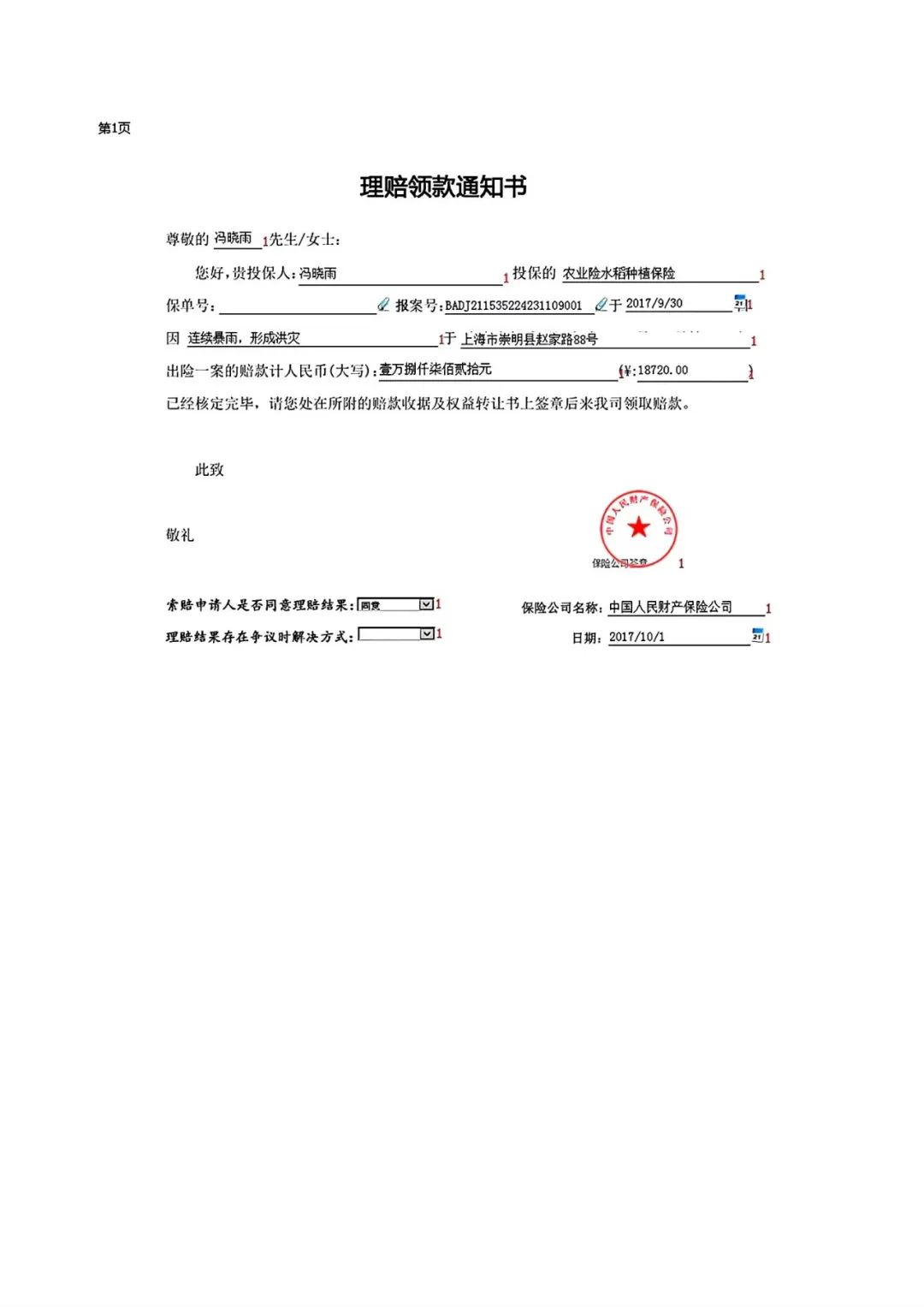

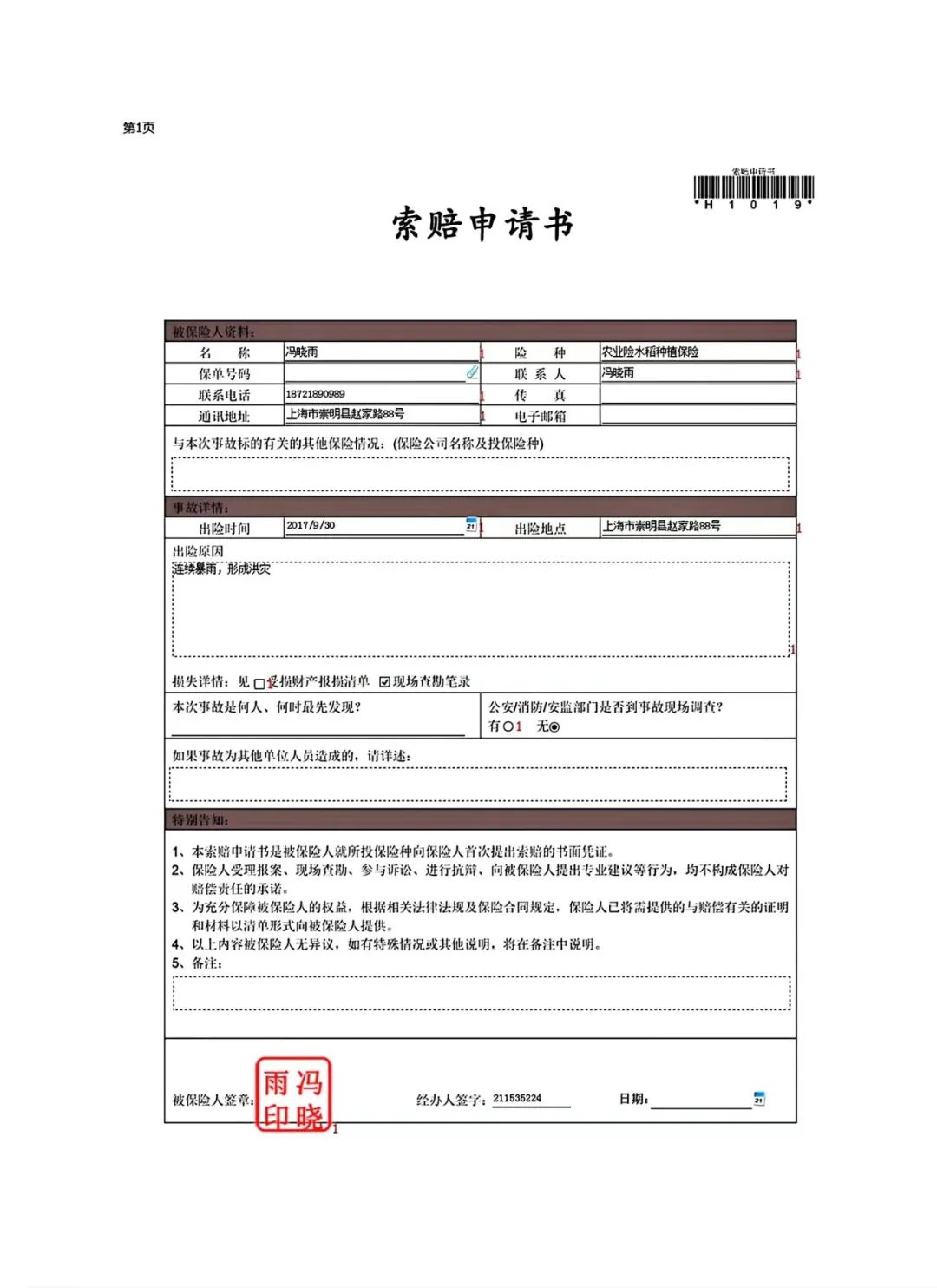

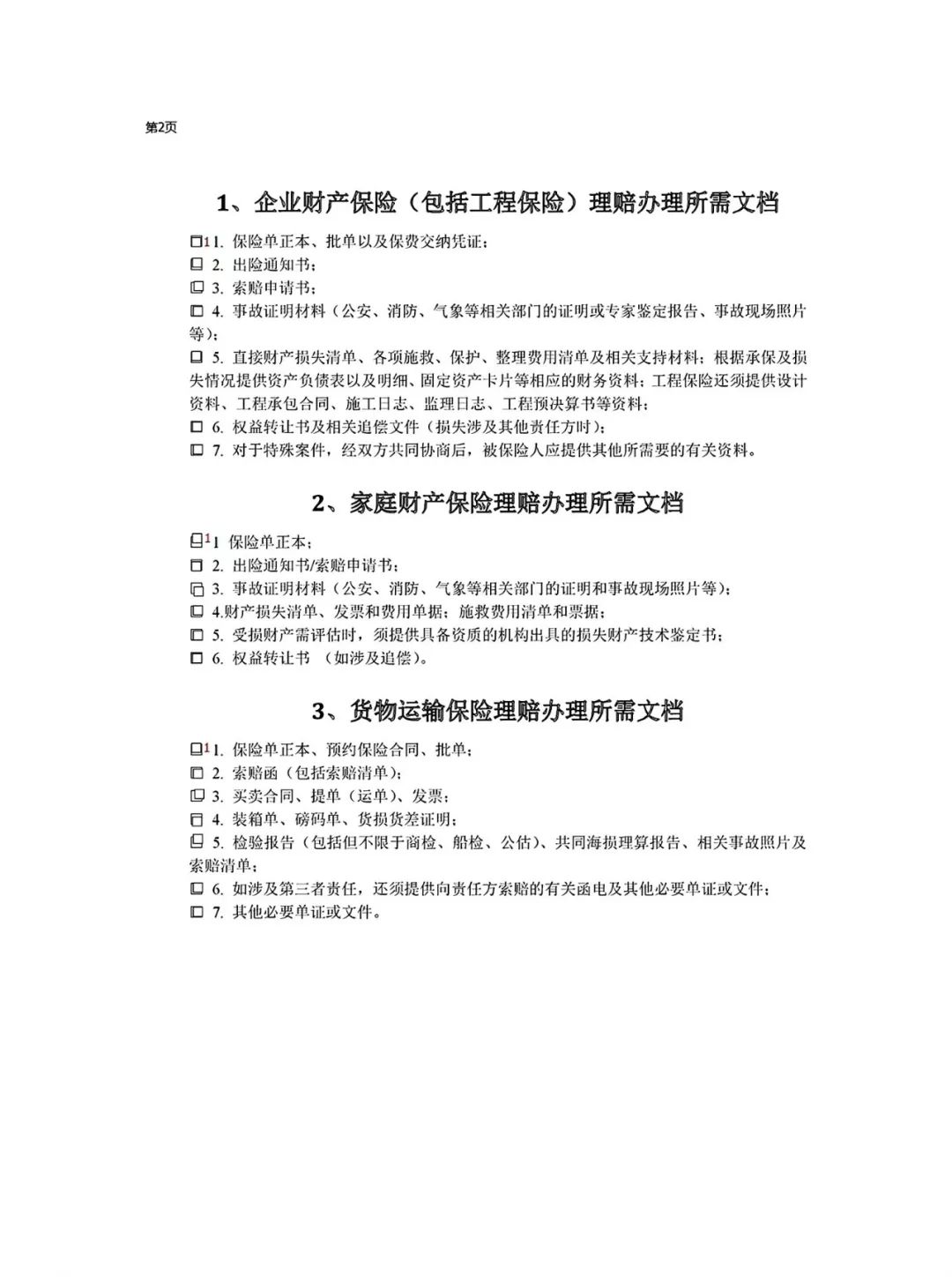

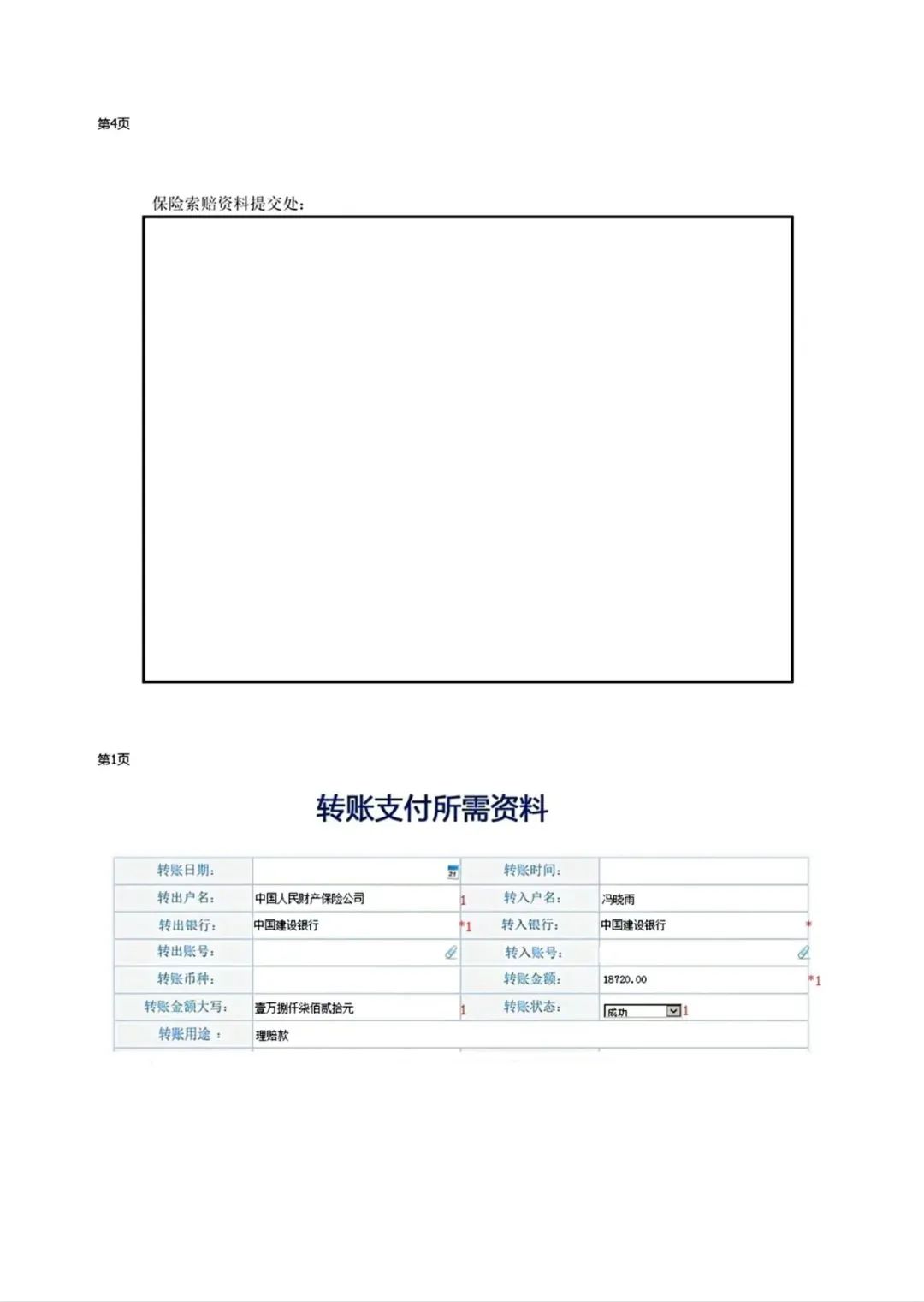

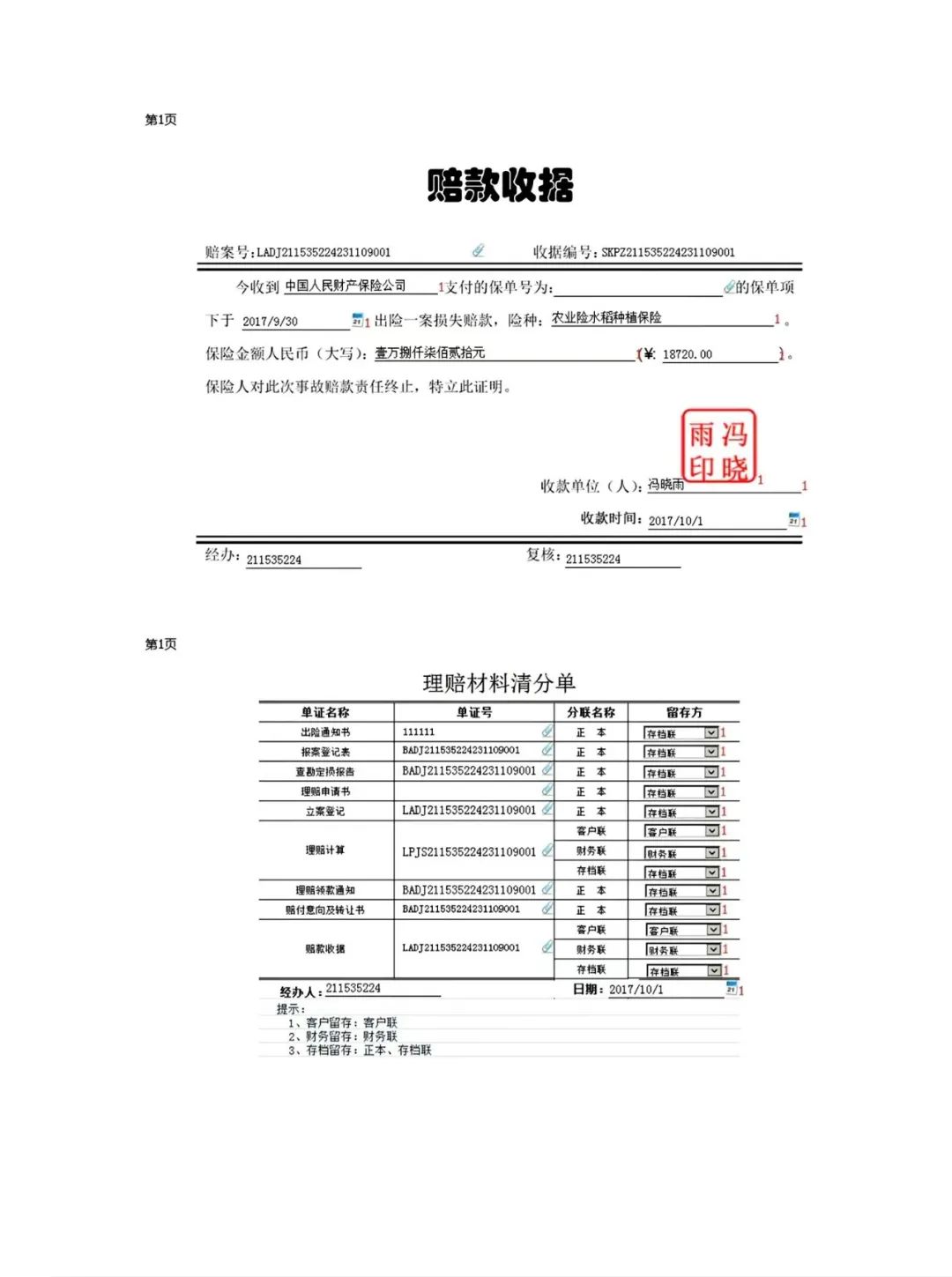

保险公司理赔内勤向客户发送了索赔单证,索赔申请人冯晓雨提交了索赔申请书等相关索赔材料。保险公司理赔内勤根据现场查勘情况及申请人提交的相关理赔材料进行了立案处理并完成了理赔计算。经理赔经理核赔后及时通知了申请人冯晓雨,冯晓雨确认理赔结果后填写了赔付意向书。付款银行及收款银行都为中国建设银行。

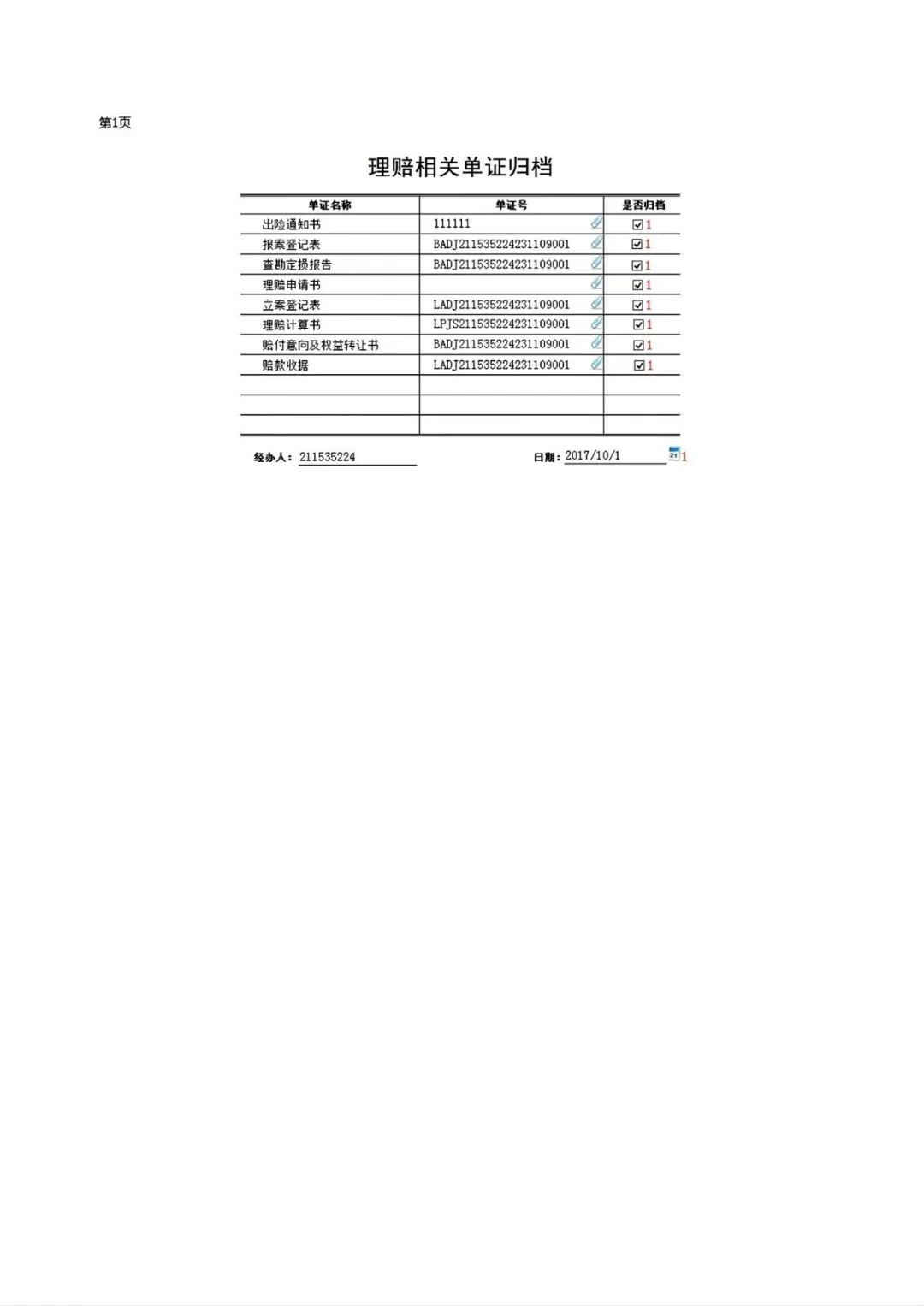

赔款支付完成后,保险公司理赔内勤当天对相关索赔单证进行了清分并归档。

投保人信息

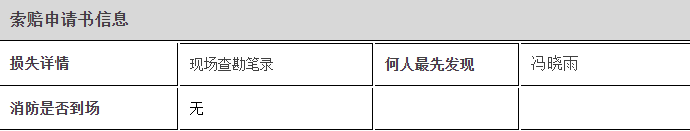

索赔申请书信息

实验报告

test report

More

关注我,了解更多!

如有侵权,请联系删除~

文案 | Cici

排版 | Cici